31 January 2022

ASX : BEZ

- Besra Gold Inc admitted to the Australian Securities Exchange October 2021.

- Bau Gold Project, Sarawak Malaysia hosts:

- a gold Resource of 73.6 Mt @ 1.43 g/t for 3.3Moz of gold

- an Exploration Target of between 4.89 and 9.27Moz of gold @ 1.7–2.5 g/t Au1.

- Drilling has commenced on the initial 3,000 – 4,000 m program at Bau.

- 675m of fully cored drilling completed on the Jugan Project which hosts:

- First batch of samples despatched for assay analysis – results imminent.

- Environmental Impact Assessment commenced for Jugan Project.

- In-country technical, logistical, and administrative footprints re-established at Bau township.

The Board of Besra Gold Inc (ASX : BEZ) (“Besra” or “Company”) is pleased to provide this maiden Quarterly Activities Report following its listing on ASX on 8 October 2021.

[1] Refer Prospectus dated 8 July 2021 in Section 3.11 and Attachment G.

[2] Jugan Exploration Target ranges between 2.0 – 3.2 million Oz based on a range of grades of 1.82 – 2.50 Au g/t, refer Prospectus dated 8 July 2021.

[3] The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

“Besra has made exceptional progress in becoming fully operational at Bau during the December 2021 Quarter. We have established a functional office in the Bau township, and our team has mobilised the logistical support that allowed drilling to commence in early November. Drilling has progressed well, thanks to our professional technical team, community support and effective COVID policies. Visual inspection of the drill core from Jugan is consistent the pre-drill expectations of sulphide mineralisation. We look forward to reporting the initial results which are due imminently.

Bau Gold Project

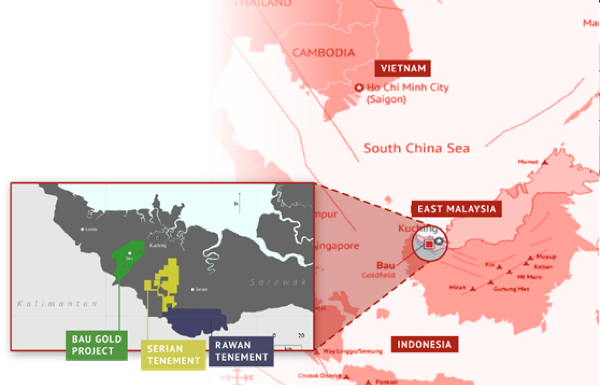

The Bau Gold Project is located 30 – 40km from Kuching, the capital city of the State of Sarawak, Malaysia, on the island of Borneo (Figure 1).

Besra controls, directly and indirectly, a 97.8% interest (92.8% on an equity adjusted basis) in the Bau Gold Project. This project lies at the western end of the arcuate metalliferous belt extending through the island of Borneo. In Kalimantan (the Indonesian jurisdiction portion of Borneo), this belt is associated with significant gold mining areas including Kelian (7Moz) and Mt Muro (3Moz).

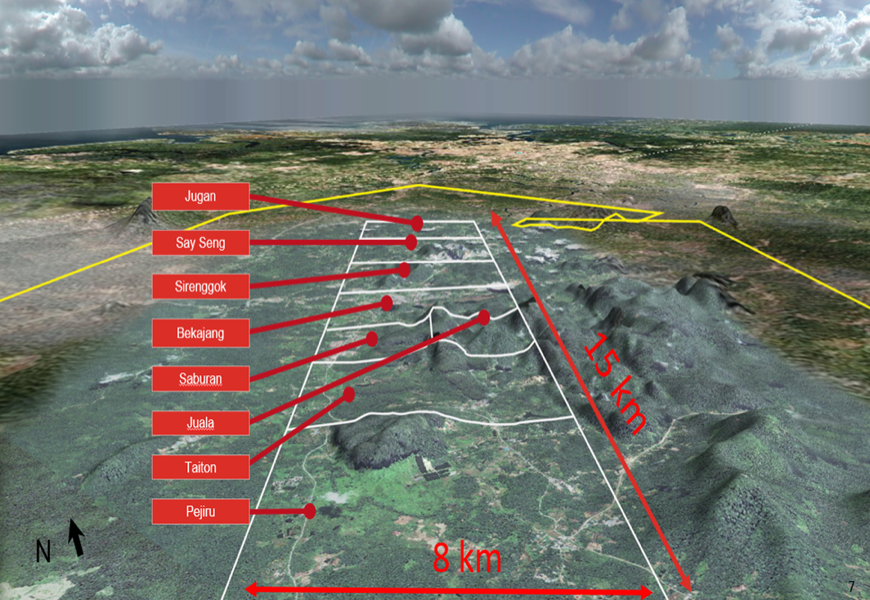

The Bau Gold Project is defined by a system of gold endowment extending within an 8 km x 15 km  Figure 1 – Regional setting of Bau Gold Project. Inset shows tenement interests within Sarawak

Figure 1 – Regional setting of Bau Gold Project. Inset shows tenement interests within Sarawak

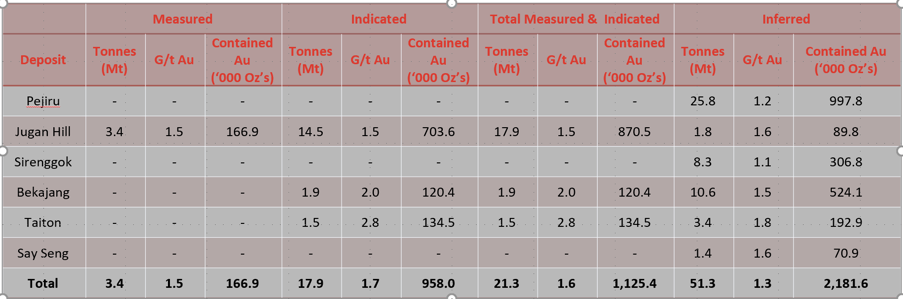

Table 1 – JORC 2012 Compliant Resource Inventory for Bau Gold Field

Table 1 – JORC 2012 Compliant Resource Inventory for Bau Gold Field

corridor, centred on the township of Bau. The Company has identified total mineral resources estimated at 72.6Mt @ 1.4 g/t for 3.3 million ounces of gold across a number of deposits (Table 1) and has an Exploration Target ranging between 4.9 and 9.3Moz3 (on a 100% basis). The project is well serviced by first class infrastructure including access to deep water ports, international airport, grid power, communications, and a multitude of service providers.

Bau Drilling Program

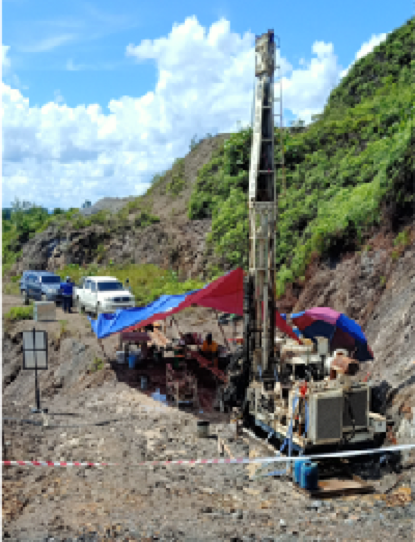

During the December 2021 Quarter Besra successfully negotiated drilling, technical and logistical support contracts as well as completed land access arrangements, to commence drilling at the Bau Gold Project. Drillcorp Malaysia Sdn Bhd was contracted to provide two rigs to undertake diamond hole drilling. This program, of between 3,000m – 4,000m, is the first drilling conducted at the Bau Gold Project since 2017-2018.

Jugan drilling

Drilling commenced at the Jugan Project, located approximately 6 km NE of Bau township (Figure 2). Jugan is the most advanced of the projects at the Bau Gold Project, having a JORC Resource of:

-

-

- A Measured + Indicated Resource1 of 870,000oz at 1.5 g/t Au;

- An Inferred Resouce2 of 90,000oz at 1.6 g/t Au; and

-

-

-

- An additional Exploration Target of 2.0 – 3.2 Moz2,3 at 1.8 – 2.5 g/t Au.

-

Figure 2 – Location of deposits along the Bau goldfield corridor

Figure 2 – Location of deposits along the Bau goldfield corridor

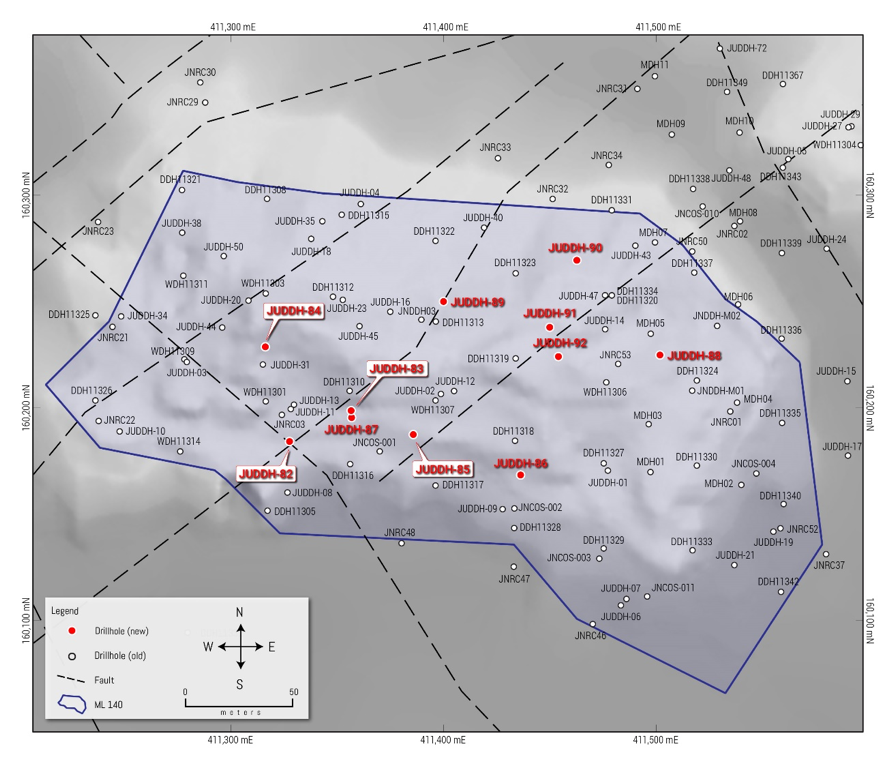

In total 11 holes will be fully cored for a total of approximately 1,100 m of drilling (Table 2) designed to provide in-fill and step-out control within the shallow crestal portion of the Jugan mineralised zone. As at the end of the December 2021 Quarter seven holes had been completed, with logging and sampling completed on five (Figure 3). During December 2021 samples for drill holes JUDDH 82, 83, 84, & 85 were despatched to SGS’s laboratories in Pt Klang Malaysia for assay analysis. The assay results are imminent.

|

Hole ID |

Project |

Easting |

Northing |

Elevation |

Declin. |

Azimuth |

Depth |

|

| JUDDH-82 |

Jugan |

411330 |

160185 |

20 |

-90 |

|

62.9 |

|

| JUDDH-83 |

Jugan |

411360 |

160200 |

29 |

-90 |

|

55.1 |

|

| JUDDH-84 |

Jugan |

411315 |

160230 |

34 |

-90 |

|

80.1 |

|

| JUDDH-85 |

Jugan |

411390 |

160187 |

25 |

-90 |

|

55.5 |

|

| JUDDH-86 |

Jugan |

411435 |

160170 |

20 |

-90 |

|

59.1 |

|

| JUDDH-87 |

Jugan |

411360 |

160220 |

29 |

-50 |

335 |

79.2 |

|

| JUDDH-88 |

Jugan |

411500 |

160220 |

35 |

-50 |

45 |

117.4 |

|

| JUDDH-89 |

Jugan |

411400 |

160250 |

30 |

-50 |

45 |

234.3 |

|

| JUDDH-90 |

Jugan |

411465 |

160275 |

25 |

-50 |

45 |

183.4 |

|

| JUDDH-91 |

Jugan |

411450 |

160238 |

32 |

-90 |

|

On-going |

|

| JUDDH-92 |

Jugan |

411450 |

160220 |

40 |

-90 |

|

On-going |

|

| Table 2- Jugan Project diamond drill holes | ||||||||

Although the area is easily assessable, the specific locations of each drill pad have required access ways, culverts and lay-out areas to be prepared (Figure 3). The location of the drill hole program at Jugan is shown on Figure 4 and the specifications of each hole are tabulated in Table 2.

Figure 3 – Montage of drill pad preparation and diamond drilling at Jugan borehole JUDDH-82

Figure 4- Location of the 2021-2022 JUDDH-82 to 92 DDH hole program, Jugan Project

Figure 4- Location of the 2021-2022 JUDDH-82 to 92 DDH hole program, Jugan Project

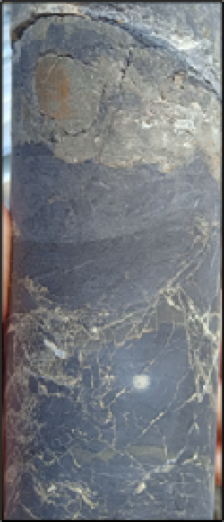

Visual sulphide mineralisation has been observed in core recovered from all holes. The sulphides at Jugan are dominated by arsenopyrite with subordinate pyrite, either as highly disseminated fine grain occurrences mostly within shale shales or more concentrated occurrences associated within veining, stockworks, sand laminations and occasional breccia (Figure 5).

Because of its refractory style, gold mineralisation is normally correlated with the presence of sulphides and visible gold in core is very rare.

The occurrences of sulphide mineralisation at Jugan are consistent with pre-drill expectations.

Figure 5 – Drill core showing typical sulphide related mineralisation within veining at JUDDH89 core (left) and close-up of a more intense zone of sulphide mineralisation in JUDDH90 (right)

Jugan Environmental Impact Assessment

During the Quarter, Chemsian Konsultant Sdn Bhd was mandated to undertake an Environmental Impact Assessment of the Jugan Project, an area of approximately 300 hectares, encompassing MLs 140 and 1/2013/1D. This EIA is a process of evaluating the likely environmental impacts associated with a future proposed development proposal of the Jugan Project involving mining and processing. The EIA will be used for decision-making purposes by the Natural Resources and Environment Board of Sarawak and other relevant agencies.

Jugan Environmental Impact Assessment

During the Quarter, Chemsian Konsultant Sdn Bhd was mandated to undertake an Environmental Impact Assessment of the Jugan Project, an area of approximately 300 hectares, encompassing MLs 140 and 1/2013/1D. This EIA is a process of evaluating the likely environmental impacts associated with a future proposed development proposal of the Jugan Project involving mining and processing. The EIA will be used for decision-making purposes by the Natural Resources and Environment Board of Sarawak and other relevant agencies.

Pejiru Project

Drilling is scheduled to commence at Pejiru at the completion of the drilling program at Jugan and will target extensions to the Pejiru Mineral Resource which has already been delineated:

Previous drilling intercepts to be followed up included:

-

-

- KPDDH01 – 32 m @ 11.4 g/t;

- KPRC 65 – 55m @ 2.3 g/t;

- KPRC02 – 81 m @ 3.26 g/t, including:

- 11 m @ 12.13 g/t; and

- KPRC 66 – 20 m @ 1.8 g/t.

-

[4] The Pejiru Exploration Target ranges between 1.7 – 3.3 million Oz based on a range of grades of 1.76 – 2.44 Au g/t

[5] The potential quantity and grade of the Exploration Targets is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration work will result in the estimation of a Mineral Resource.

Administration Footprint

Besra has rapidly established its operational centre in the township of Bau including upgrading the office and living quarters and communications. New core and sample shed facilities have been constructed (Figure 7).

Figure 6 – Meeting with Pejiru stakeholders

Figure 6 – Meeting with Pejiru stakeholders

Technical and logistical support for the drilling operations has been contracted to Geoimpact Resources. Geoimpact include a group of very experienced geologists and operational specialists several of whom had previously worked at Bau with Besra and with the drilling contractors Drillcorp Sdn Bhd. Overall supervision is provided by Kevin Wright, Project Manager.

During the Quarter the Company met with community leaders, landowners, and other stakeholders at Bau (Figure 6) to discuss forecast exploration plans, project management, access needs and the implementation of COVID public health care protocols for employees and contractors consistent with national and state government regulations.

Figure 7 -Besra’s newly constructed core handling, processing, and storage facilities at Bau

Figure 7 -Besra’s newly constructed core handling, processing, and storage facilities at Bau

Corporate

On 22 April 2021 the Company filed a prospectus (“Original Prospectus”) with the Australian Securities and Investment Commission (“ASIC”) that would restructure the Company’s financial position through an initial public offering (“IPO”) of the Company’s common shares in the form of Chess Depository Receipts (“CDIs”) on the ASX.

Following the ASIC’s statutory review of the Original Prospectus, the Company filed a Replacement Prospectus on 8 July 2021 and a Supplementary Prospectus on 16 September 2021. The Original Prospectus, Replacement Prospectus and Supplementary Prospectus are herein referred to collectively as the “Prospectus”.

The Company received Conditional Admission approval from the ASX on 24 September 2021 and was admitted to the Official List of the ASX on 6 October 2021, and its securities (in the form of CDI’s) quoted and commenced trading on 8 October 2021.

Following Conditional Admission, the Company issued the following CDIs on 29 September 2021[6]:

-

-

- 83,942,611 issued to the Secured Creditors.

- 52,274,000 issued to Pre-IPO Investors.

- 69,844,355 issued under the Noteholder Offer.

- 532,457 issued to settle certain trade creditors.

- 12,500,000 issued to Gladioli Enterprises Sdn Bhd (“Gladioli”) under the SPSA Variation (refer below).

- 20,000,000 issued to Pangaea Resources Limited (“Pangaea”) under the SPSA Variation (refer below).

- 50,218,484 issued under the Public Offer to raise $10,043,697.

-

Proceeds from the IPO were recorded as ‘restricted cash’ at 30 September 2021 and became available to use upon admission to the ASX on 8 October 2021.

As at 30 September 2021 and 31 December 2021 the Company had 294,130,529 common shares on issue.

Having listed in October 2021, the Company was not required to file quarterly reports for the quarter ended 30 September 2021. The Company’s unaudited Condensed Interim Consolidated Financial Statements and Management Discussion and Analysis for the quarter ended 30 September 2021, prepared in accordance with Canadian reporting requirements, were filed on 1 November 2021 at www.sedar.com and are available on the Company’s website. Future quarterly reports will be filed with ASX.

In December 2021, the Company issued a notice for its Annual General and Special Shareholder Meeting held on 7 January 2022. All Resolutions put to that Meeting were passed.

[6] Refer the Prospectus for full details

Ownership interest in Bau

Besra is in a consortium with a Malaysian group with Bumiputra interests that owns rights to consolidated mining tenements covering much of the historic Bau goldfield in Sarawak, East Malaysia. Besra’s interests in the Bau Gold Project are held through its direct and indirect interests in North Borneo Gold Sdn Bhd (“NBG”). Besra’s 100% owned subsidiary – Besra Labuan Ltd (“Besra Labuan”)- acquired its interest in NBG, which owns rights to the mining tenements covering the area of Bau in accordance with the agreement for the sale of shares in NBG between Gladioli, Besra Labuan and Mr. Ling Lee Soon (guarantor of Gladioli) dated 1 October 2010, as amended, and restated on 12 May 2013 and 17 November 2016 (“SPSA”).

Under the terms of the SPSA Besra was required to pay a further US$7.6 million consideration to Gladioli to acquire the remaining shares in NBG. In March 2021, in consideration of the issue to Gladioli of 12.5 million Besra CDIs, Gladioli, Besra and Besra Labuan agreed to a further amendment of the SPSA and to release Besra and Besra Labuan of their obligations to complete the purchase of the remaining shares in NBG (“SPSA Variation”).

Pangaea agreed to acquire 16,221 shares in NBG for cash consideration of $4.0 million and Besra agreed to acquire 14,419 shares in NBG from Pangaea by issuing 20.0 million CDIs to Pangaea.

Pangaea acquired the 14,419 NBG shares on 7 July 2021. Upon the issue of the 12.5 million and 20 million CDIs on 29 September 2021 to Gladioli and Pangaea, respectively, Besra’s interests in NBG increased to 97.8% and its equity adjusted interest increased to 92.8%.

Finance and Listing Rule 5.3 Disclosure

In accordance with obligations contained in ASX Listing Rule 5.3.4, Besra provides the following information with respect to its Use of Funds Statement as set out in its Prospectus and its actual expenditure since ASX admission. [7]

| Use of Funds | Actual Expenditure | Prospectus Estimates |

| $’000 | $’000 | |

| Exploration, evaluation and Bau Project development | 888 | 5,213 |

| Indodrill and SGS settlement agreements | 485 | 541 |

| Administration and general working capital | 401 | 1,105 |

| Loan agreement and creditor settlement payments (included in the above line item in the Prospectus) | 1,188 | 1,448 |

| Transaction costs associated with the Listing | 1,682 | 1,693 |

| Net borrowings | 328 | – |

| SPSA Variation costs of financing | 400 | – |

As disclosed in the Prospectus the Company had limited cash reserves prior to the Listing. Delays to the completion of the Company’s IPO resulted in transaction costs associated with the Listing being higher than estimated. In order to support the preparation of the Original Prospectus, Replacement Prospectus and Supplementary Prospectus and meet general working capital requirements prior to Listing, the Company entered into a number of short-term working capital loans on arm’s length terms and conditions. Those loans were repaid from the proceeds from the IPO.

ASX Listing Rule 5.3.5 Disclosure – Payments to related parties during the quarter as outlined in sections 6.1 and 6.2 of the Appendix 5B consisted of the following:

-

-

- Non-executive director fees included in staff costs for services provided during the quarter totalled $59,000 are included in 1(d) of Appendix 5B.

- Executive director fees for services provided during the quarter and capitalised to exploration and evaluation costs totalled $41,000 are included in 2.1(d) of Appendix 5B.

- As outlined in the Company’s Prospectus, certain directors had accrued directors fees for the financial years up to and including 30 June 2021 and through to 30 September 2021. Amounts totalling $206,000 were paid during the quarter in part settlement of amounts due and are included in outlays at 3.9 of Appendix 5B. In addition, as outlined in section 9.7 of the Prospectus, amounts due on working capital loans to certain directors were repaid during the quarter and included at 3.9 of Appendix 5B.

- At the request of Besra, in order to ensure that the Company’s listing could proceed, Pangaea entered in the SPSA Variation. As outlined at section 8.4 of the Prospectus, Gladioli agreed to sell, and Pangaea agreed to purchase, the Remaining NBG Shares (as defined in the Prospectus). Following this, Pangaea agreed to sell, and Besra agreed to purchase, a portion of the Remaining NBG Shares. In consideration for this variation, Besra agreed to issue 12.5 million CDIs to Gladioli and 20.0 million CDIs to Pangaea, each of which are subject to 24 month ASX escrow. Besra subsequently agreed to reimburse Pangaea for its third-party transaction, legal and financing costs (on an out-of-pocket basis) associated with the SPSA Variation and meeting its commitments to Gladioli. Pangaea was reimbursed $200,000 in each of October and November 2021 in full satisfaction of its finance and arrangement costs associated with the $4.0 million payment to Gladioli. These amounts are included in 3.9 of Appendix 5B.

-

[7] Forecast expenditure classifications used in the Prospectus may differ from the classifications used in the Appendix 5B.

This ASX release was authorised by the the Audit Committee of Besra Gold

For further information:

| Australiasia | North America |

| Ray Shaw Chief Executive Officer Email: ray.shaw@besra.com |

James Hamilton Investor Relations Services Mobile: +1 416 471 4494 Email: jim@besra.com |

Competent Person’s Statement

The information in this Announcement that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Mr. Kevin J. Wright, a Competent Person who is a Fellow of the Institute of Materials, Minerals and Mining (FIMMM), a Chartered Engineer (C.Eng), and a Chartered Environmentalist (C.Env). Mr. Wright is a consultant to Besra. Mr. Wright has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code (2012 Edition) of the Australasian Code for Reporting of Exploration Results, and a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

Kevin J. Wright consents to the inclusion in this Announcement of the matters based on his information in the form and context that it appears.

Disclaimer

This Announcement contains certain forward-looking statements and forecasts concerning future activities, including potential delineation of resources. Such statements are not a guarantee of future performance and involve unknown risks and uncertainties, as well as other factors which are beyond the control of Besra Gold Inc. Actual results and developments may differ materially from those expressed or implied by these forward-looking statements depending upon a variety of factors. Nothing in this Announcement should be construed as either an offer to sell or a solicitation of an offer to buy or sell securities.

Unless otherwise indicated, all mineral resource estimates and Exploration Targets included or incorporated by reference in this Announcement have been, and will be, prepared in accordance with the JORC classification system of the Australasian Institute of Mining and Metallurgy and Australian Institute of Geoscientists.

The information in this announcement is based on the following publicly available announcements previously lodged on the SEDAR platform:

- Besra Gold Inc Bau Gold Project Sarawak Malaysia Exploration Target Inventory. Lodged SEDAR Platform Feb 26, 2021;

- Besra Bau Project – Mineral Resource and Ore Reserve Updated to JORC 2012 Compliance. Lodged SEDAR Platform Nov 22, 2018;

which are available on https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00001815 or on Besra’s website www.besra.com.

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.

Besra (Accipiter virgatus), also called the besra sparrowhawk, occurs throughout southern and eastern Asia. It is a medium sized raptor with short broad wings and a long tail making it very adept at manoeuvring within its environment and an efficient predator.