ASX ANNOUNCEMENT

13 December, 2022

ASX : BEZ

Not for release to US wire services or distribution in the United States

NON-RENOUNCEABLE ENTITLEMENT OFFER TO RAISE APPROXIMATELY $5.1 MIL.

HIGHLIGHTS

Besra is undertaking a 1 for 3 Non-Renounceable Entitlement Offer of CDIs at $0.05 per CDI to raise approximately A$5.1m (before costs) (“Entitlement Offer”).

Proceeds from the Entitlement Offer will be applied to:

Jugan Resource Review & Feasibility Studies;

Jugan Test Processing Plant;[1]

Resource Exploration & Drilling;

In-Country administration and overheads; and

General working capital and administration.

The offer price of $0.05 per CDI represents a 33.52% discount to the 15-day VWAP of Besra CDIs on ASX (being $0.075) up to and including 24 November 2022, and a discount of 10.71% to the last closing price of $0.056 on 24 November 2022.

The Entitlement Offer is fully underwritten by Quantum Metal Recovery Inc., a substantial security holder of the Company.

The Board of Besra Gold Inc (ASX:BEZ) is please to announce that it is undertaking a capital raising through a Non-Renounceable Entitlement Offer of new CDIs to Eligible Security Holders to raise approximately A$5.1m before costs.

Eligible Security Holders (defined below) will be entitled to acquire one CDI (New CDIs) for every three CDIs or three Common Shares (Securities), held at 5:00pm (AWST) on the record date for the Entitlement Offer of Thursday, 1 December 2022 (Record Date).

Proceeds from the Entitlement Offer will be used to advance the Company’s Bau Gold Field activities as well as general working and administrative costs.

CAPITAL RAISING RATIONALE

The Entitlement Offer will provide all Eligible Security Holders with an opportunity to acquire New CDIs at a discount to the current market price and retain undiluted exposure to the Company’s Bau Gold Field assets. Proceeds will provide balance sheet backing to fast-track key value-driving activities, including progressing Jugan Project pre-development and targeted exploration along the Bau Gold corridor to delineate higher grade, deeper gold mineralisation including those recently intercepted at Bekajang[2] , beneath existing known shallow Resources.

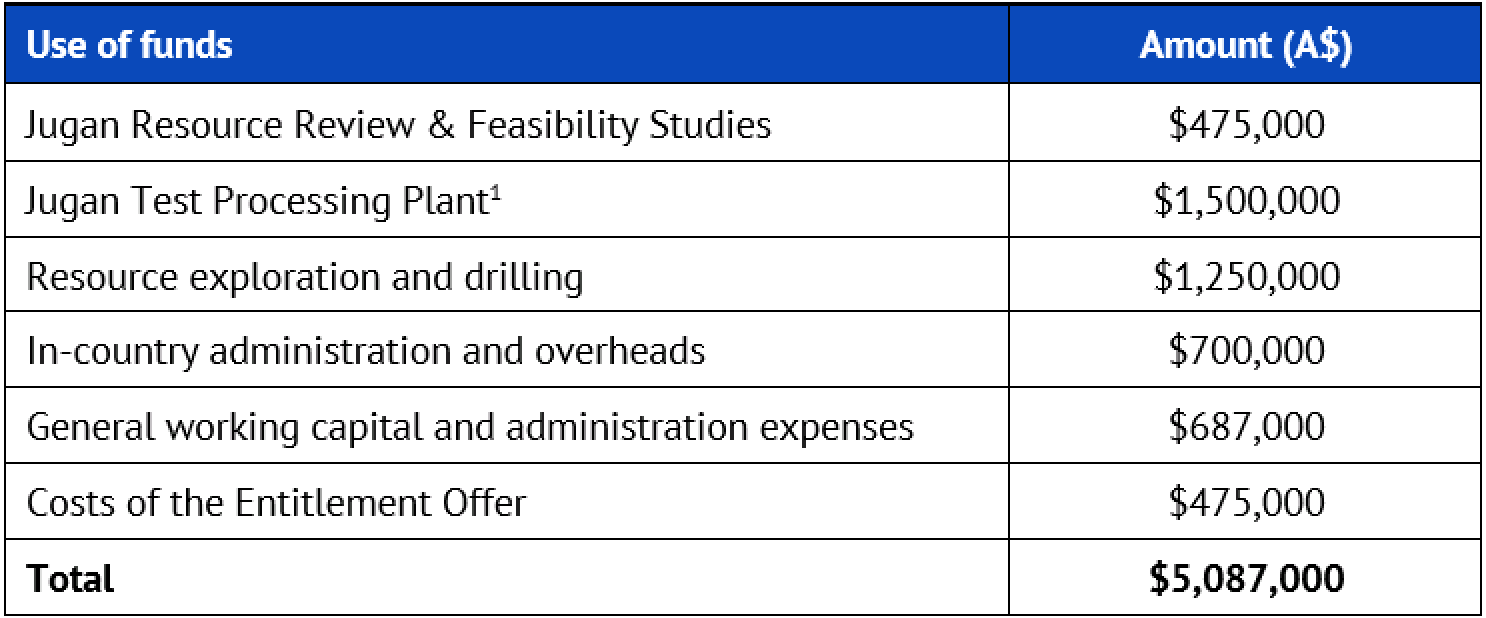

USE OF FUNDS

The proceeds of the Entitlement Offer will be used to provide working capital for the following:

The Company reserves the right to change the use of funds at its absolute discretion.

ELIGIBLE SECURITY HOLDERS

The Entitlement Offer may only be accepted by Eligible Security Holders, being holders of CDIs or common shares as at the Record Date, with a registered address on the Company’s Share Register in Australia, New Zealand, Belize, Malaysia, United Kingdom, Canada (accredited investors only) and the United States (accredited investors in Connecticut, Florida, Minnesota, New York and Texas only).

Entitlements are non-renounceable and cannot be sold, traded on ASX or any other exchange, or privately transferred by Security Holders.

SHORTFALL FACILITY

As part of the Entitlement Offer, Eligible Security Holders who subscribe for their full entitlement may also apply for additional CDIs in excess of that entitlement at the same issue price of $0.05 per New CDI (Shortfall Facility).

The Shortfall Facility provides an opportunity for Eligible Security Holders to apply for additional CDIs to top up their holdings (Additional Allocation). Although there is no cap on the maximum number of New CDIs that individual Security Holders can apply for, there is no guarantee regarding the number of New CDIs (if any) will be available to Eligible Security Holders under the Shortfall Facility, additional to their entitlements under the Entitlement Offer. This will depend on how many entitlements are taken up. If all entitlements are taken up under the Entitlement Offer, then there will be no New CDIs available under the Shortfall Facility.

In the event that demand for New CDIs under the Shortfall Facility exceeds the total number of New CDIs that are available under the Entitlement Offer, applications under the Shortfall Facility will be scaled back on a pro-rata basis at the discretion of the Company.

UNDERWRITING

The Entitlement Offer is fully underwritten by Quantum Metal Recovery Inc (Quantum), a substantial shareholder of Besra, on terms and conditions of an Underwriting Agreement with the Company. The Underwriting Agreement contains customary conditions, representations and warranties and is subject to termination events as summarised in the investor presentation released on the date of this announcement. Quantum is entitled to fees under the Underwriting Agreement, as set out in the Appendix 3B released on the date of this announcement.

The Company has also released a cleansing statement under section 708AA(2)(f) of the Corporations Act 2001 (Cth) which sets out the potential control impacts of the Entitlement Offer, including with respect to Quantum’s underwriting.

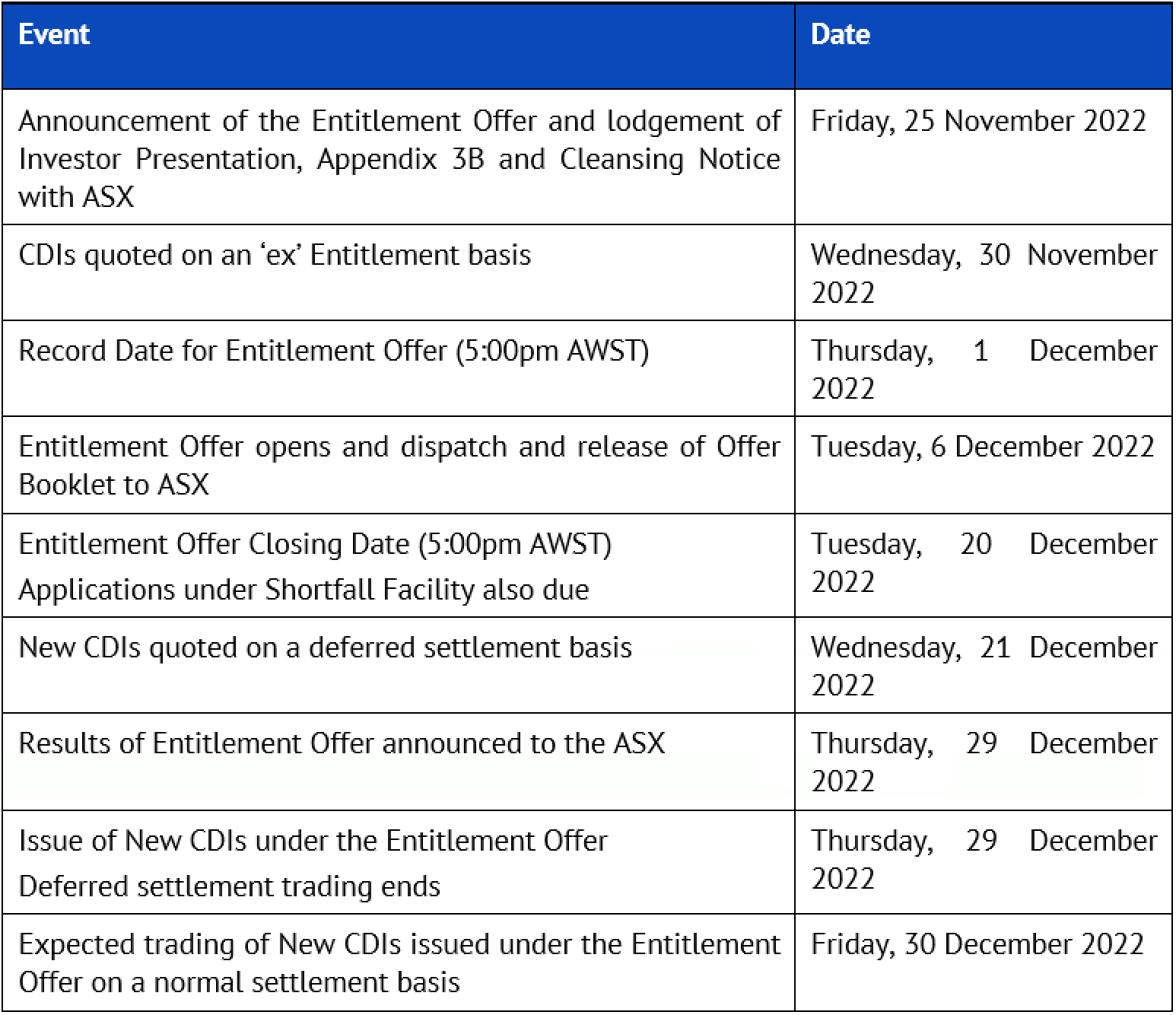

INDICATIVE TIMETABLE

Notes to Table

All dates and times are Australian Western Standard Time (AWST). The indicative timetable is subject to variation. The Company reserves the right to alter the timetable at its discretion and without notice, subject to ASX Listing Rules and the Corporations Act and other applicable law. In particular, Besra, in conjunction with the Underwriter, reserves the right to, either generally or in particular cases, change any of the key dates and to accept late applications or to withdraw the Entitlement Offer without prior notice. The commencement of quotation of New CDIs is subject to confirmation from ASX.

An Appendix 3B for the New CDIs to be issued pursuant to the Entitlement Offer follows this announcement.

For those Security Holders who have elected to receive documents from the Company via email, they will receive the Entitlement Offer documents and their personal entitlement and acceptance form directly to their nominated email address. As a consequence, these Security Holders will not be sent a hard copy of the documents by mail.

All dollar amounts in this announcement are in Australian dollars unless otherwise indicated.

This announcement has been approved for release by the Board of Directors.

Disclaimer

All statements, other than statements of historical fact, which address activities, events or developments that Besra believes, expects or anticipates will or may occur in the future, are forward-looking statements.

Such statements are not a guarantee of future performance and involve unknown risks and uncertainties, as well as other factors which are beyond the control of Besra. Actual results and developments may differ materially from those expressed or implied by the forward-looking statements in connection with the Entitlement Offer depending upon a variety of factors. Nothing in this announcement should be construed as either an offer to sell or a solicitation of an offer to buy or sell securities.

Not an offer in the United States

This announcement has been prepared for publication in Australia and may not be released to US wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act of 1933 and may not be offered or sold in the United States except in transactions exempt from, or not subject to, the registration requirements of the US Securities Act and applicable US state securities laws.

[1] Prior EIA approval required before commencing activities.

[2] Refer ASX release dated 22 November 2022.