ASX ANNOUNCEMENT

30 October 2024

ASX: BEZ

- 30 September 2024 cash balance of A$24m more than satisfies the Company’s funding requirements to:

✓ complete the Jugan Definitive Feasibility Study (DFS);

✓ commission the Jugan Pilot Plant and complete all processing trials; and

✓ progress other Bau Gold Field opportunities.

- Increased momentum and progress for the renewal of ML 05/2012/1D.

- Jugan Pilot Plant construction pending renewal of ML 05/2012/1D.

- Specialist processing equipment, fabricated in China, delivered to Bau secure site for temporary storage.

- Definitive Feasibility Study inputs, involving various metallurgy test work, infill and sterilisation drilling programs, progressing with positive results;

- Significant appointments made, including Mr Michael Higginson as a non-executive director, Mr Matthew Antill to head the Jugan Project mining and development team and Ms Renee Minchin as the Company’s Chief Financial Officer.

The Board of Besra Gold Inc (ASX: BEZ) (Besra or the Company) is pleased to provide this Quarterly Activities Report for the 3 months ended 30 September 2024 (September Quarter), which accompanies the September Quarter Cash Flow Report.

Jugan Project

As part of the Company’s Definitive Feasibility Study for future commercialisation of the Jugan Project the following activities were undertaken during the September Quarter.

Mining Equipment and Site Preparation

All specialist processing equipment fabricated and supplied by Yantai Jinpeng Mining Machinery Co of China was delivered to site during the September Quarter and is now in temporary secure storage at Bau.

Pilot Plant layout modifications to incorporate access to a strategic parcel of land (Lot 300) adjoining ML 05/2012/1D were finalised during the September Quarter. Primarily, this involved the relocation of a Dry Stack Tailings Facility onto this Lot. A novel approach to laying the tailings in benches separated by impermeable clays, will limit potential surface water contamination and significantly reduce the footprint of the tailings dam, associated sedimentation and settlement ponds.

A revised Environmental Sedimentation Control Plan incorporating these design changes will be lodged with the Department of Drainage and Irrigation during the current Quarter.

Renewal of ML 05/2012/1D, which is due to expire in January 2025, progressed very satisfactorily during the September Quarter and positive meetings with key decision makers were held during October 2024. This renewal is the first “heavy mining” ML considered by the Sarawak authorities for some time, who deal primarily with quarry scale activities. Accordingly, the timetable for renewal is not as predictable as counterpart applications made in, for example, Australian jurisdictions.

Whilst a final decision on the renewal application has not yet been received, Bersa remains confident that its considerable ongoing efforts will be duly rewarded.

Metallurgical Test Work and Processing Studies

Offsite metallurgical test work and studies continued during the September Quarter, including:

Bio-oxidation Leaching Trials

SGS-Metro South African reported on initial trial results involving bio-oxidation trails of samples of the Jugan concentrate.

The results have been encouraging with all samples amenable to bio-oxidation. Rates of sulphide oxidation following bio-oxidation pre-treatment of 97-98% were achieved. Leaching of the BIOX residues showed that the gold dissolution can be increased to 96% -98% compared to direct cyanidation of the same concentrate samples, not subject to oxidation yielding gold dissolution of 9%-16%

Bio-oxidation is one of the possible processes for oxidising the Jugan concentrate. This method relies on microorganisms to oxidise the concentrate and is considered to be environmentally more friendly than other options. SGS-Metso has world patents on bio-oxidation leaching and a working knowledge of Jugan’s refractory ore characteristics.

Reagent Trials

Sheyang Florrea Chemical’s Indonesian subsidiary continued specialist processing trials to determine appropriate types and quantities of reagents best suited to flotation separation of Jugan’s refractory ores. Reagents are used to preferentially enhance and/or suppress target compounds. Using combinations of reagents known for their frothing and collecting capabilities, the trials will help determine the optimal reagent regimes for efficient separation and recovery of Jugan’s gold bearing sulphides.

Further combinations of reagents have been suggested following initial trials and the scope broadened to include aeration studies of the flotation cells. Properly designed air aspiration could prove to be the optimum process, subject to strict management of reagents & pulp level.

Drilling Program

On 17 July 2024 the Company announced the results of infill and sterilisation assay results[1] and sterilisation drilling. Assay results from sterilisation holes, JUDDH-101 to -109, consistently met, and in some instances bettered, pre-drill expectations, including encountering mineralisation below the footwall thrust, traditionally interpreted as the base of mineralisation at Jugan. The sterilisation drilling program was undertaken to determine the proportions of Resource and waste rock in the southwest portion of ML 05/2012/1D, where the mill and flotation plant facilities, as well as ROM stockpile and conveyor systems are to be located.

Infill Drilling

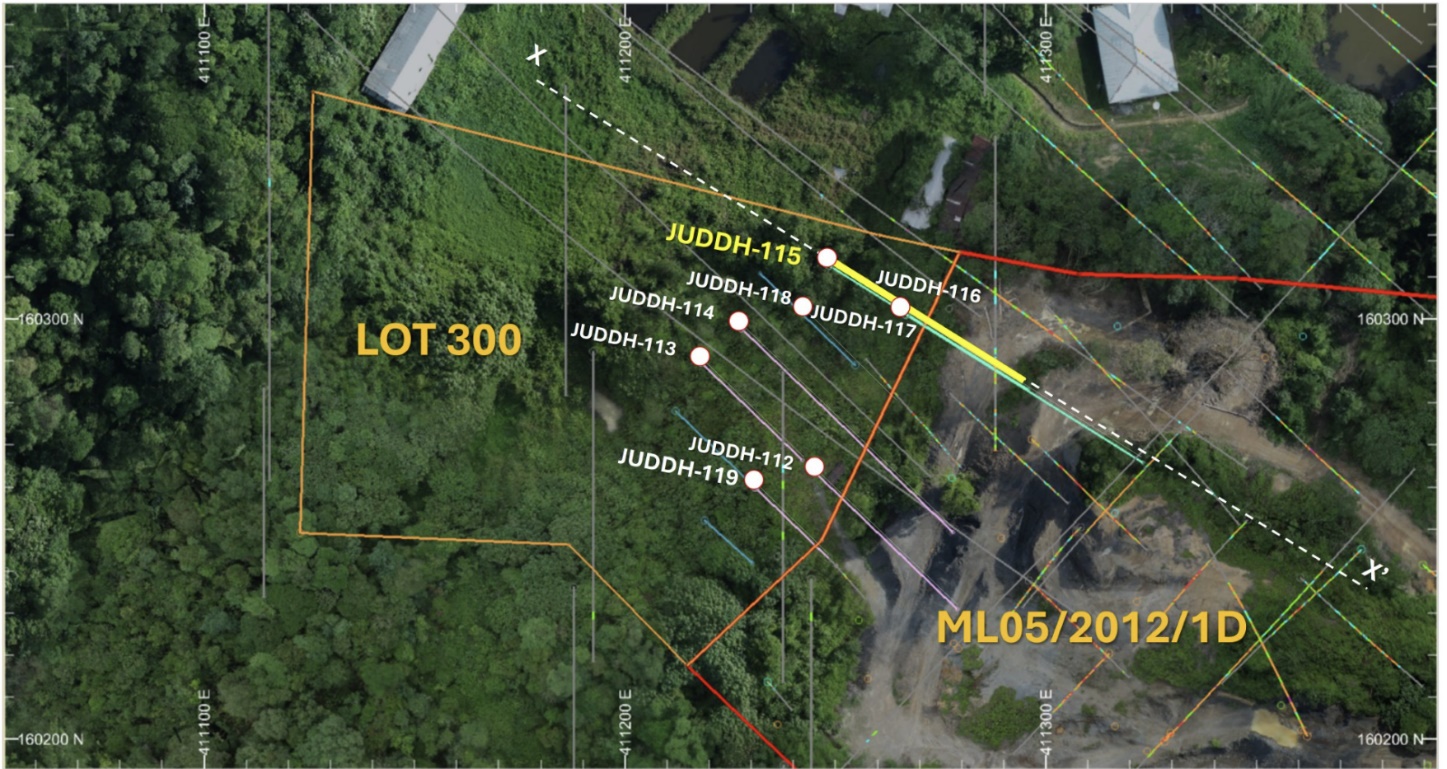

Infill drilling during the September Quarter focused on a series of inclined ESE directed holes drilled from pads located within Lot 300. This trajectory provided more effective intercepts of the steeply plunging segment of the Jugan mineralisation, than otherwise achievable from pads located within ML 05/2012/1D.

Figure 1 – Location of JUDDH-114, confirming the overall geometry of the mineralised envelope.

Fully cored diamond drill holes JUDDH-112 (partial) to JUDDH-118 (partial) were completed in the September Quarter, with JUDDH-119 and -120 (partial) completed since 30 September 2024 (Table 1). Core samples up to JUDDH-117 have been prepared and despatched for analysis by Intertek in Indonesia.

The infill drilling program is aimed at increasing the overall JORC 2012 compliant Resources inventory, as well as those proportions classifiable as Measured or Indicated. The updated Resource inventory will be used to estimate Mineable Resources and Reserves, based on a range of mine pit configuration scenarios as part of the Detailed Feasibility Studies, including evaluation of a combination open-pit and underground development scenarios. A number of factors, including higher gold commodity prices, land position considerations around waste dump and tailings storage facility requirements, now broaden and challenge the large open pit mine development assumptions contained in the 2013 Feasibility Study.

Table 1 – Collar locations and specifications of infill drilling during the September Quarter.

| BHID | XCOLLAR | YCOLLAR | ZCOLLAR | DH_DEPTH | AZIMUTH | INCLINATION |

| JUDDH-112 | 411245.18 | 160263.45 | 18.72 | 119.4 | 134 | -60.0 |

| JUDDH-113 | 411218.04 | 160289.63 | 12.16 | 110.3 | 134 | -72.0 |

| JUDDH-114 | 411227.66 | 160297.72 | 11.51 | 150.0 | 134 | -60.0 |

| JUDDH-115 | 411248.59 | 160312.65 | 14.53 | 215.6 | 132 | -82.0 |

| JUDDH-116 | 411266.76 | 160300.97 | 20.59 | 185.0 | 312 | -87.0 |

| JUDDH-117 | 411241.19 | 160301.99 | 12.62 | 181.1 | 134 | -65.0 |

| JUDDH-118 | 411241.19 | 160301.99 | 12.62 | 173.8 | 134 | -87.0 |

| JUDDH-119 | 411230.95 | 160259.84 | 15.52 | 83.8 | 134 | -70.0 |

| JUDDH-120 | 411230.95 | 160259.84 | 15.52 | 80.8 | 134 | -90.0 |

BEKAJANG PROJECT AREA

Following the applications for the renewal of the three contiguous concessions (ML 01/2012/1D, ML 02/2012/1D, 1D/134/ML/2008) covering the 102Ha Bekajang Project Area (Figure 2), several base-line field studies were undertaken during the September Quarter. These included soil and water quality and survey of the aquatic ecosystem within the tailings dams (Figure 3). Details of the basis for renewal of these MLs was outlined in the June 2024 Quarterly Report, disclosed to the market on 31 July 2024

Figure 2 – sampling the soil profile at Bekajang for base-line contaminants.

Figure 3 – Bekajang Project Area showing ML boundaries and JORC (2012) footprint (brown).

Future Activities

With its strong cash position, the Company continues to execute its 2024 activities without reliance on equity market funding.

Construction of the Jugan Pilot Plant can commence once the authorities have renewed ML 05/2012/1D and approved it for mining activities.

Infill drilling will continue within the Jugan Project footprint over the coming Quarter as part of further delineation of the Resource and Reserve potential for inclusion in mineable resources and reserve estimations, as well as development of pit and potential underground mining options. It is expected that infill drilling coupled with additional sterilisation drilling will continue into the new year at Jugan, before moving to other prospect areas.

As appropriate, further metallurgical testing will be conducted including trial tests on concentrate to ascertain the optimal processing regime in order to produce a dore product on site.

In addition to metallurgical test work, process flow evaluation of a pressure oxide leach method (POX) to produce bullion on site by treating both flotation concentrates through a POX circuit to make a residue to be treated by CIL (carbon in leach), as well as treating flotation tails sent directly to CIL circuit. This is a similar process flow to that being planned by De Grey Mining Ltd’s Hemi Project.

High level mine planning activities will be conducted to lead the strategy for the Definitive Feasibility Study, specifically to evaluate the benefits of including a smaller and lower stripping ratio open pit design than what was assumed in the 2013 Feasibility Study, offset by the inclusion of an underground mine design incorporating modern mechanised underground bulk mining methods.

Corporate

Gold purchase Agreement

Besra confirms that the Gold Purchase Agreement (GPA) has not been cancelled or terminated and that Quantum Metal Recovery Inc. (Quantum) has advised that Besra has sufficient funds to satisfy its current funding requirements and that Quantum intends to re-commence making payments pursuant to the GPA upon installation of the Jugan Pilot Plant, as Quantum sees no need to provide further funding at this stage.

Mr Dato Lim, Chairman of both Besra and Quantum, provided the following statement:

“As Chairman of Quantum, the largest CDI holder in Besra with a substantial 30% ownership, I intend to address the market directly to reaffirm Quantum’s enduring commitment to Besra’s growth and to our mutual success under the GPA.’

“Under the GPA, Quantum has provided over US$25.6 million in non-dilutionary funds to Besra, underscoring Quantum’s deep-rooted confidence in the Bau Gold Project’s potential and our dedication to seeing it move into full commercial production.”

Matthew Antill

On 17 October 2024, the Company announced that its Jugan Project leader, Mr Matthew Antill (BEng [Mining] and Fellow of AUSIMM), had commenced work ahead of schedule.

Mr Antill has joined as Managing Director of Besra’s Malaysian operating subsidiary, North Borneo Gold Sdn Bhd where he will head the mining and development team.

Mr Antill will have responsibility for moving the Jugan Project towards commercialisation, through Pilot Plant production and delivery of a Definitive Feasibility Study.

Mr Antill’s career spans over three decades in mining and mine development, with significant senior operational management experience and oversight of studies in both open pit and underground operations. He specialises in gold, including refractory and narrow vein operations.

Board and senior management

During the September Quarter, the Company made the following appointments:

- On 1 August 2024, the Company announced the appointment of mine development specialist, Mr Matthew Antill (see above);

- On 15 August 2024, the Company announced the appointment of Ms Renee Minchin as the Company’s Chief Financial Officer; and

- On 6 September 2024, Mr Michael Higginson was appointed as a Non-Executive Director of the Company (Mr Higginson is independent of Quantum).

In addition, the Company is currently looking to appoint two additional independent mining experienced directors.

As at the date of this announcement, the Board of the Company comprises the following:

- Dato’ Lim Khong Soon – Chair (appointed as a Director on 27 September 2023);

- Chang Loong Lee – Executive Director (appointed as a Director on 27 September 2023);

- Jon Morda – Non-Executive Director (appointed as a Director on 16 August 2005); and

- Michael Higginson – Non-Executive Director (appointed as a Director on 6 September 2024).

In accordance with section 102(2) of the Canadian Business Corporations Act, the Company has two directors that are not officers or employees of the Company or its affiliates, namely Messrs Dato’ Lim and Jon Morda.

The Company advises that it has not appointed a Chief Executive Officer. Accordingly, Mr Lee being the Company’s only Executive Director is required to assume the role (from time to time) of CEO of the Company.

The Company further advises that when it refers in announcements and financial statements to the ‘Chair’ of the Company, then it is also referring to the Company’s ‘Board Chair’, as that term is defined in the Company’s Board Charter.

Legal proceedings

Superior Court of Justice (Ontario)

On 27 September 2024, the Company announced the it had received a Statement of Claim in respect to the commencement of legal proceedings (Proceedings) in the Superior Court of Justice (Ontario) against Besra along with 7 other defendants (including the directors of Besra) by Prana GP Limited (incorporated in Jersey), Talisman 37 Limited (incorporated in Jersey) and Concept Capital Management Ltd (incorporated in the Marshall Islands) (collectively the Plaintiffs).

The claims made by the Plaintiffs relate to the affairs of Besra with respect to its dealings with Quantum Metal Recovery Inc. The Plaintiffs claim that Besra and the other defendants have behaved in a manner that is oppressive to the Plaintiffs, and that Besra’s board of directors have breached their fiduciary duties.

On 23 October 2024, the Company announced the engagement of Canadian lawyers who will be defending the Proceedings on behalf of the Company.

The Company advises all shareholders that (despite the Company’s strong desire to do so) it has been advised that because the Proceedings are before the Superior Court of Justice (Ontario), it is unable to make any public statements in relation to the Proceedings.

Proceedings against the Socialist Republic of Vietnam

On 4 September 2024, the Company entered into a Deed of Indemnity with Hok Holdings Limited (HOK) (an entity associated with former officers of the Company, Messrs David A Seton and Paul F Seton) whereby HOK agreed to indemnify and hold harmless Besra and its successors and assigns and Besra Labuan Limited and both entities respective directors from and against all costs arising directly from a claim, including any orders of adverse costs made against Besra Labuan Limited.

The indemnity arises as a result of potential proceedings being made by HOK against the Socialist Republic of Vietnam following the acquisition by HOK, in 2017, of the Company’s interest in the Phuoc Son Gold Project and the Bong Mieu Gold Project (both located in Vietnam) for a consideration of US$1. Such acquisition being approved by the shareholders of the Company at an Annual and Special Meeting of shareholders held on 23 May 2017.

The Company confirms that it will receive no benefit whatsoever from the proceedings by HOK against the Socialist Republic of Vietnam.

Reported loss for the year ended 30 June 2024

The Company refers to a number of queries received in relation to its audited financial statements for the year ended 30 June 2024 that were lodged with ASX on 30 September 2024.

Specifically, the Company advises that the significant contributing components of the Company’s US$13.6m comprehensive loss included the following $11.23m of non-cash items:

- US$4.63m accretion charge (calculated in accordance with the accounting standards), being the accrued value of the cost of the financing component of the contract notes relating to the US$25.6m received pursuant to the GPA;

- an exploration and evaluation impairment charge of US$3.5m;

- share based payment charge of US$1m for the issue of 25m incentive options; and

- US$2.1m fee in relation to the issue of 11,111,111, CDIs to Quantum at an issue price of A$0,09 per CDI (noting that at the time of issue, the market price of Besra CDIs was A$0.295 per CDI).

Annual General Meeting

The Company’s Annual General Meeting is to be held at 12:30pm on Friday 20 December 2024 at the offices of Hall Chadwick, Level 40, 2 Park Street, Sydney, New South Wales, Australia 2000.

Agenda items include the following:

- to receive and consider the audited consolidated Financial Statements for the financial year ended June 30, 2024 and the Independent Auditor’s Report thereon;

- the Election of all directors;

- reappointment of Hall Chadwick as Auditor of the Company;

- approval to issue 7,000,000 options to Chang Loong Lee; and

- non-binding resolution to adopt the executive remuneration for the fiscal year ended 30 June 2024.

CAPITAL STRUCTURE

| Quoted Securities | Number |

| Chess Depository Interests 1:1 | 418,100,906 |

| Unquoted Securities | Number |

| Options expiring 08-October-2025 Restricted | 7,142,275 |

| Options expiring 08-October-2026 Restricted | 3,625,000 |

| Class B Performance Rights Restricted | 3,650,000 |

| Common Shares | 4,818,622 |

| Options exercisable at $0.45 expiring 31 December 2026 | 5,000,000 |

| Options exercisable at A$0.25 expiring 1 December 2026 | 10,000,000 |

| Options exercisable at A$0.45 expiring 1 December 2026 | 10,000,000 |

ADDITIONAL ASX LISTING RULE DISCLOSURES

ASX Listing Rule 5.3.1 – Payments for direct exploration expenditure during the September Quarter totalled $1,101k (YTD $1,101k.)

ASX Listing Rule 5.3.2 – The Company has not yet commenced mining production and development activities.

ASX Listing Rule 5.3.5 – payments to related parties during the September Quarter as outlined in sections 6.1 and 6.2 of the Appendix 5B consisted of executive and non-executive Director fees and fees paid to a related party are included as staff costs for services provided during the September Quarter totalling $179k are included in 1.2(d) of the attached Appendix 5B.

This announcement was authorised for release by the Board of Besra Gold Inc.

For further information, please contact:

| Australasia | North America |

| Michael Higginson

Company Secretary Email: michael.higginson@besra.com |

James Hamilton

Investor Relations Services Mobile:+1 416 471 4494 Email: jim@besra.com |

[1] ASX Release July 17 2024

Concession Interests in the Bau Goldfield Corridor

| Holder | ML No | Project | Area (Ha) | Expiry Date | Interest* |

| Bukit Lintang Enterprises Sdn Bhd | 1D/134/ML/2008 | Bekajang | 40.5 | 11/06/2025

Renewal pending |

98.5% interest (93.5% on an equity-adjusted basis) |

| Bukit Lintang Enterprises Sdn Bhd | ML/01/2012/1D | Bekajang | 12.74 | 18/01/2025

Renewal pending |

98.5% interest (93.5% on an equity-adjusted basis) |

| Gladioli Enterprises Sdn Bhd | ML/04/2012/1D | Bau Gold corridor | 52.1 | 9/01/2025 | 98.5% interest (93.5% on an equity-adjusted basis) |

| Gladioli Enterprises Sdn Bhd | ML/05/2012/1D | Jugan | 5.28 | 23/05/2025

Renewal pending |

98.5% interest (93.5% on an equity-adjusted basis) |

| Bukit Lintang Enterprises Sdn Bhd | ML 142 | NW Bekajang | 38.4 | 11/06/2025 | 98.5% interest (93.5% on an equity-adjusted basis) |

| Bukit Lintang Enterprises Sdn Bhd | ML/02/2012/1D | Bekajang | 49.81 | 22/06/2024

Renewal pending |

98.5% interest (93.5% on an equity-adjusted basis) |

| Buroi Mining Sdn Bhd | ML 138 | NW Pejiru | 409.5 | 19/11/2025 | 98.5% interest (93.5% on an equity-adjusted basis) |

| Gladioli Enterprises Sdn Bhd | ML 01/2013/1D | Jugan/Sirenggok | 380.2 | 22/01/2033 | 98.5% interest (93.5% on an equity-adjusted basis) |

| Gladioli Enterprises Sdn Bhd | MC/KD/01/1994 | Pejiru/Jugan/Sirenggok | 1,694.90 | 26/10/2014. Renewal pending | 98.5% interest (93.5% on an equity-adjusted basis) |

| *Interests shown as at 30 September 2024. All interests are as a result of direct and indirect shareholdings in North Borneo Gold Sdn Bhd, a SPV established between the Gladioli Group of companies & Besra – Refer Sections 3.4 and 8.4 of the Prospectus dated 8 July 2021. | |||||

Competent Person’s Statement

The information in this Announcement that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Mr. Kevin J. Wright, a Competent Person who is a Fellow of the Institute of Materials, Minerals and Mining (FIMMM), a Chartered Engineer (C.Eng), and a Chartered Environmentalist (C.Env). Mr. Wright is a consultant to Besra. Mr. Wright has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code (2012 Edition) of the Australasian Code for Reporting of Exploration Results, and a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

Kevin J. Wright consents to the inclusion in this Announcement of the matters based on his information in the form and context that it appears.

Appendix 5B

Mining exploration entity or oil and gas exploration entity quarterly cash flow report

| Name of entity | ||

| Besra Gold Inc. | ||

| ARBN | Quarter ended (“current quarter”) | |

| 141 335 686 | 30 September 2024 | |

| Consolidated statement of cash flows | Current quarter $A’000 |

Year to date

(3 months) $A’000 |

|

|---|---|---|---|

| 1. | Cash flows from operating activities | – | – |

| 1.1 | Receipts from customers | ||

| 1.2 | Payments for | – | – |

|

|||

|

– | – | |

|

– | – | |

|

(185) | (185) | |

|

(828) | (828) | |

| 1.3 | Dividends received (see note 3) | – | – |

| 1.4 | Interest received | 47 | 47 |

| 1.5 | Interest and other costs of finance paid | – | – |

| 1.6 | Income taxes paid | – | – |

| 1.7 | Government grants and tax incentives | – | – |

| 1.8 | Other (provide details if material) | (433) | (433) |

| 1.9 | Net cash from / (used in) operating activities | (1,399) | (1,399) |

| 2. | Cash flows from investing activities | – | – |

| 2.1 | Payments to acquire or for: | ||

|

|||

|

– | – | |

|

– | – | |

|

(1,101) | (1,101) | |

|

– | – | |

|

– | – | |

| 2.2 | Proceeds from the disposal of: | – | – |

|

|||

|

– | – | |

|

– | – | |

|

– | – | |

|

– | – | |

| 2.3 | Cash flows from loans to other entities | – | – |

| 2.4 | Dividends received (see note 3) | – | – |

| 2.5 | Other (provide details if material) | – | – |

| 2.6 | Net cash from / (used in) investing activities | (1,101) | (1,101) |

| 3. | Cash flows from financing activities | – | – |

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | ||

| 3.2 | Proceeds from issue of convertible debt securities | – | – |

| 3.3 | Proceeds from exercise of options | – | – |

| 3.4 | Transaction costs related to issues of equity securities or convertible debt securities | – | – |

| 3.5 | Proceeds- Gold Purchase Agreement | – | – |

| 3.6 | Repayment of borrowings | – | – |

| 3.7 | Transaction costs related to Gold Purchase Agreement | – | – |

| 3.8 | Dividends paid | – | – |

| 3.9 | Other (provide details if material) | – | – |

| 3.10 | Net cash from / (used in) financing activities | – | – |

| 4. | Net increase / (decrease) in cash and cash equivalents for the period | Current quarter $A’000 |

Year to date

(3 months) $A’000 |

| 4.1 | Cash and cash equivalents at beginning of period | 27,208 | 27,208 |

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (1,399) | (1,399) |

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (1,101) | (1,101) |

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | – | – |

| 4.5 | Effect of movement in exchange rates on cash held | (851) | (851) |

| 4.6 | Cash and cash equivalents at end of period | 23,857 | 23,857 |

| 5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts |

Current quarter $A’000 |

Previous quarter $A’000 |

| 5.1 | Bank balances | 23,857 | 27,208 |

| 5.2 | Call deposits | – | – |

| 5.3 | Bank overdrafts | – | – |

| 5.4 | Other – ‘restricted cash’ that became available for use upon admission to ASX | – | – |

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 23,857 | 27,208 |

| 6. | Payments to related parties of the entity and their associates | Current quarter $A’000 |

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 179 |

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | – |

| Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments.

6.1 – Non-Executive director fees included in staff costs for services provided during the quarter. Directors who have resigned are considered related party for 6 month following resignation. 6.2 – Executive director fees for services provided during the quarter and capitalised to exploration and evaluation costs. |

||

| 7. | Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity.Add notes as necessary for an understanding of the sources of finance available to the entity. |

Total facility amounts at quarter end $A’000 |

Amount drawn at quarter end $A’000 |

| 7.1 | Loan facilities | – | – |

| 7.2 | Credit standby arrangements | – | – |

| 7.3 | Other (please specify) | – | – |

| 7.4 | Total financing facilities | – | – |

| 7.5 | Unused financing facilities available at quarter end | – | |

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

| 8. | Estimated cash available for future operating activities | $A’000 |

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | (1,399) |

| 8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | (1,101) |

| 8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (2,500) |

| 8.4 | Cash and cash equivalents at quarter end (item 4.6) | 23,857 |

| 8.5 | Unused finance facilities available at quarter end (item 7.5) | – |

| 8.6 | Total available funding (item 8.4 + item 8.5) | 23,857 |

| 8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 10 |

| Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | ||

| 8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: | |

| 8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | ||

| Answer: | ||

| 8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | ||

| Answer: | ||

| 8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | ||

| Answer: | ||

| Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | ||

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 30 October 2024

Authorised by: By the Board of Besra Gold Inc

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.